SaaS Metrics that Drive Valuations Series – Acquiring Customer at the Right Price

Navidar | June 23, 2017

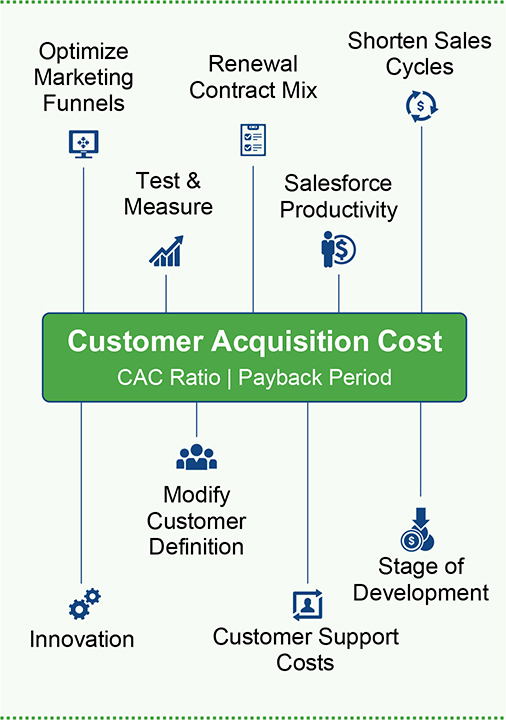

The costs associated with acquiri ng customers, also known as CAC, is one of the most important SaaS metrics because it demonstrates how much a company spends on sales and marketing (S&M) to add new customers. CAC includes everything it takes to land customers, such as advertising, marketing, sales, trial support, and on-boarding as well as the costs associated with prospects that did not become customers. Because companies are tempted to pursue customers regardless of cost, time, and relative/absolute results, CAC also serves as a sanity check for customer lifetime value (CLTV). For a detailed discussion of CLTV, please view the “Top CLTV Pitfalls” note previously published in our SaaS Metrics that Drive Valuation series.

Navidar helps our clients understand and holistically optimize CAC while incorporating CLTV and other critical SaaS metrics to maximize exit valuation. We have been the trusted advisor for many SaaS companies that call the middle-corridor of the U.S. home. Collectively, our team has completed more than 300 transactions, representing $70 billion in M&A, capital raises, and public offerings. In this article, we identify our favorite CAC metrics as well as multiple points to consider while striving for excellence.

CAC Definition. The most common CAC formula is S&M expenses divided by gross customer additions. We generally use a full year of S&M and customer adds in our CAC analysis. However, for companies with very short or long sales cycles it can make sense to use adjusted periods for one or both of these metrics.

CAC ratio is CLTV divided by CAC. Companies generally seek to minimize CAC while maximizing CLTV to optimally develop and enhance profitable, long-term customer relationships. The CAC ratio, in our opinion, should be greater than 2.5x for consumer-focused and ecommerce companies and greater than 6.0x for best in class SaaS companies, indicating that 17% or less of CLTV is spent on CAC. If this ratio is less than these benchmarks and does not improve over time, then the company may have difficulty in achieving and sustaining appropriate levels of cash flow generation. Still, there are numerous reasons for a CAC ratio to temporarily dip below these watermarks, such as an early-stage of corporate development, a new/young sales team, or upon entering new markets

Payback period is typically defined as the latest quarter’s S&M expense divided by (new recurring revenue times gross margin). This metric demonstrates the number of months it takes to pay back S&M expenses when acquiring a new customer. For SMB focused SaaS companies, payback can be as low as three to five months and for those focused on enterprises, it can be up to three years. While the lower the CAC payback period, the better in general, a low payback can also indicate opportunities to increase S&M spend.

Download Full Article Below